What is a Short Sale?

A short sale or short payoff is generally defined

as a sale in which a lender allows the property

securing a mortgage or deed of trust to be sold

for less then the existing loan balance, due to

factors such as the borrower’s financial circumstances,

the property’s physical condition, or

local real estate market conditions.

A short sale is really a form of pre-foreclosure

sale that occurs when the mortgagee agrees

to accept less than the loan amount to avoid

foreclosure. A negotiated short sale may result

in a discounted purchase price for the buyer.

The buyer then finances the acquisition much

the same as in any conventional real estate

acquisition.

Courtesy of Land Title Guarantee Company

Frascona, Joiner, Goodman, and Greenstein P.C. know all there is to know about foreclosure law. Check them out!

Complexity of Short Sales

Short sales are extremely complex transactions,

even for the experienced Realtor. Part

of the reason is that they are time-consuming.

Lenders are inundated with requests for short

sales and therefore expect all paperwork to be

complete and accurate before even considering

a short sale. Lenders may also request that

the paperwork be resubmitted multiple times,

and just getting the file itself to the lender can

sometimes present a challange.

Additionally, there is no regulation or industry

standard for short sales, meaning every lender

may have different requirements and expectations.

Even a Realtor who is familiar with the

requirements of one lender may not know the

ins and outs of another lender’s requirements.

Furthermore, lenders’ policies and processes

can change often and even vary by investor.

Courtesy of Land Title

John Marcotte

www.boulderhomes4u.com

720-771-9401

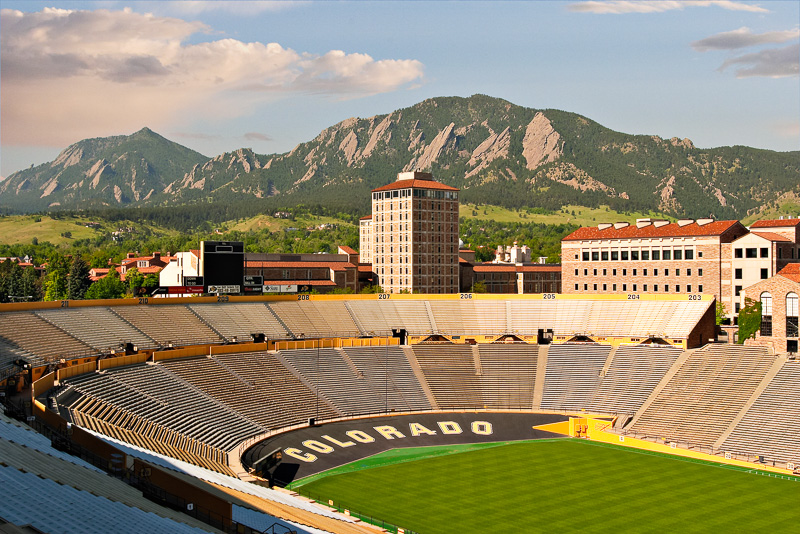

Boulder offers the perfect mix: A laid-back college town with big-city business smarts.

Boulder offers the perfect mix: A laid-back college town with big-city business smarts.